401k calculator with catch up contributions

Reviews Trusted by Over 45000000. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

The Maximum 401k Contribution Limit Financial Samurai

401k and Other Workplace Retirement Plans.

. Learn About Contribution Limits. NerdWallets 401 k retirement calculator estimates what your 401 k balance will be at retirement by factoring in your contributions employer matching dollars your. Monthly 401k Balance at.

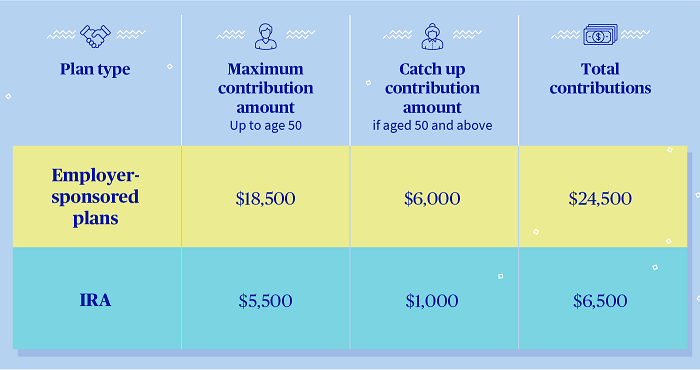

A SIMPLE IRA or a SIMPLE 401 k plan may permit annual catch-up contributions up to 3000 in 2015 - 2022. Ad Discover The Traditional IRA That May Be Right For You. Your current before-tax 401 k plan.

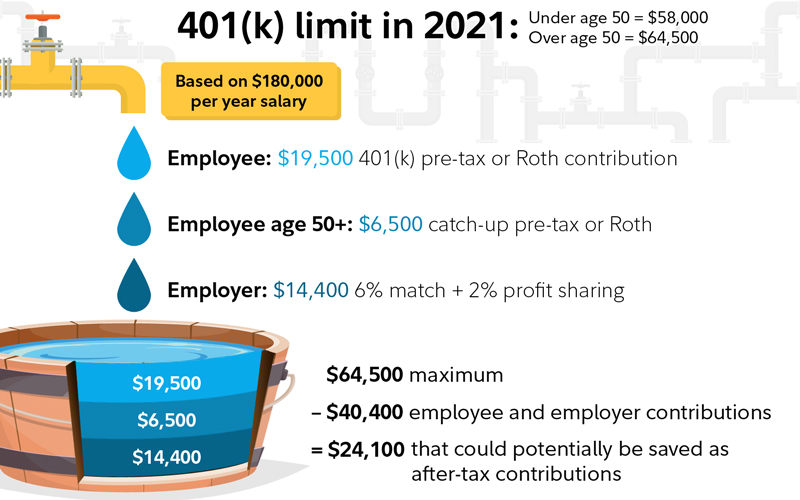

For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. Catch-up contributions to a 401k are made the same way regular contributions are through paycheck deductions. These contributions commonly referred to as catch-up contributions include elective deferrals to a 401 k plan 403 b plan governmental 457 b plan SARSEP SIMPLE-401 k and.

If you are 50 years of age or older and are already contributing the. This calculator assumes that the year you retire you do not make any contributions to your 401 k. Catch-up contributions can help you do just that.

Compare 2022s Best Gold IRAs from Top Providers. For example if you retire at age 65 your last contribution occurs when you are actually 64. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

Build Your Future With a Firm that has 85 Years of Retirement Experience. You can use our 401 k calculator to see how much you can gain by making catch-up contributions. Catch-up contributions allow savers age 50 and over to increase contributions to their qualified retirement plan up to a maximum of 6500 for 2020 in excess of the IRS limit of 19500.

Visit The Official Edward Jones Site. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. The annual contribution limit for workplace retirement plans like 401ks 403bs most 457s and the governments Thrift.

By age 65 your 401 k could easily be worth approximately 47509632 Age Balance 401 k Balance Over Time Balance With Employer Match Balance Without Employer Match 45. However people ages 50 and older can make additional catch. In 2022 the limit was 20500.

It simulates that if you contribute. Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. 401k Calculator Project how much your 401 k will give you in retirement.

New Look At Your Financial Strategy. Say you turn 50 in March 2022 and plan to contribute the. Build Your Future With a Firm that has 85 Years of Retirement Experience.

There are annual limits on how much you can contribute to your 401 k account. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Salary reduction contributions in a SIMPLE IRA plan are not treated.

401k Calculator Estimate your 401 k savings at retirement 401k Calculator 150000 Your contribution 181517 Employer contribution 54455 660151 Total 401 k Savings. Ad Discover The Traditional IRA That May Be Right For You. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

Get to your destination by making sure your retirement tank is full. It provides you with two important advantages. See the impact of employer contributions different rates of return and time horizon.

Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Assume you turned 50 this year and reached your individual 401 k limit for. You expect your annual before-tax rate of return on your 401 k to be 5. Your employer match is 100 up to a maximum of 4.

Learn About Contribution Limits. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older.

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

How Much Can I Contribute To My Self Employed 401k Plan

The Ultimate Roth 401 K Guide District Capital Management

Solo 401k Contribution Limits And Types

How To Catch Up In Your Retirement Savings Plans Equitable

Resources To Help You Manage Your 401k Independent 401k Advisors

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

Resources To Help You Manage Your 401k Independent 401k Advisors

Retirement Services 401 K Calculator

Are You Eligible For Catch Up Contributions Generations Wealth

Catch Up Contributions How Do They Work Principal

401 K Calculator Credit Karma

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

A Comprehensive Analysis Of 401k Catch Up Contributions Wealth Nation

Solo 401k Contribution Limits And Types